- Home

- »

- Sustainable Energy

- »

-

Solar Encapsulation Market Size, Share, Industry Report 2033GVR Report cover

![Solar Encapsulation Market Size, Share & Trends Report]()

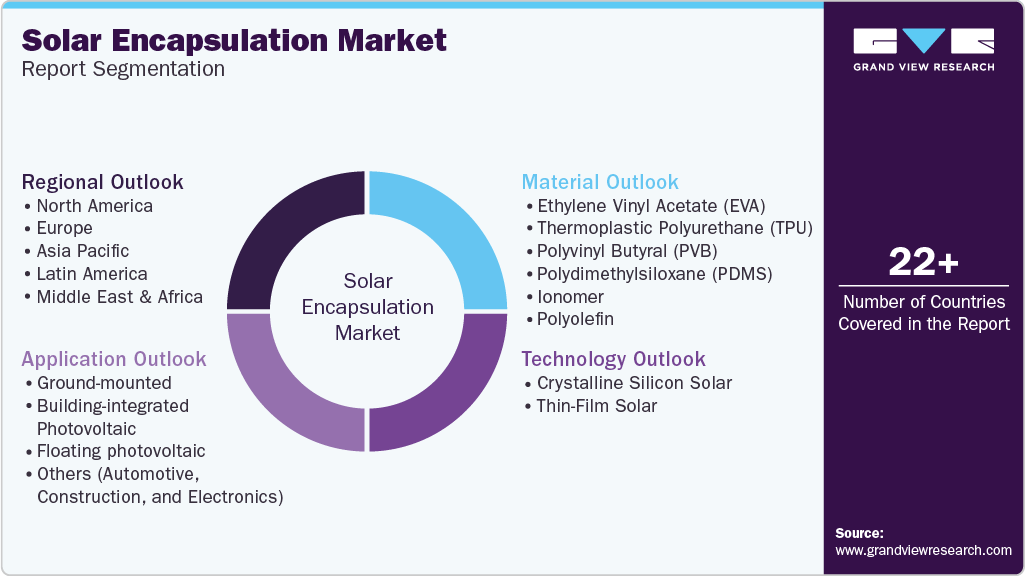

Solar Encapsulation Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Ethylene Vinyl Acetate (EVA), Thermoplastic Polyurethane (TPU)) By Technology, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-690-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Solar Encapsulation Market Summary

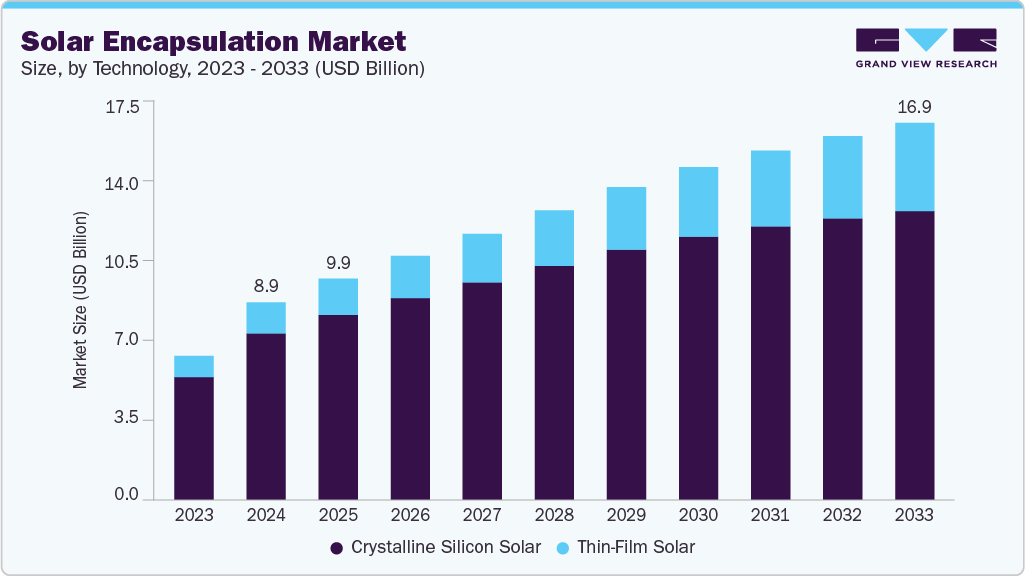

The global solar encapsulation market size was estimated at USD 8.89 billion in 2024 and is projected to reach USD 16.99 billion by 2033, growing at a CAGR of 6.9% from 2025 to 2033. Solar encapsulation refers to the protective layer in photovoltaic (PV) modules that shields solar cells from environmental damage, such as moisture, UV rays, and mechanical stress. These encapsulants enhance durability, improve efficiency, and extend the operational life of solar panels.

Key Market Trends & Insights

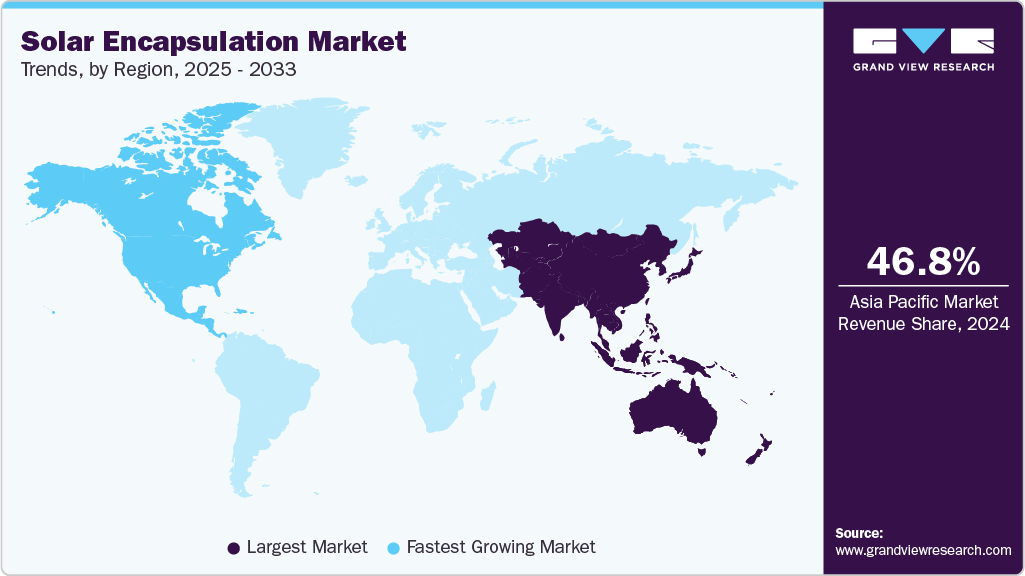

- Asia Pacific solar encapsulation market held the largest share of 62 % of the global market in 2024.

- The solar encapsulation industry in the U.S. is expected to grow significantly over the forecast period..

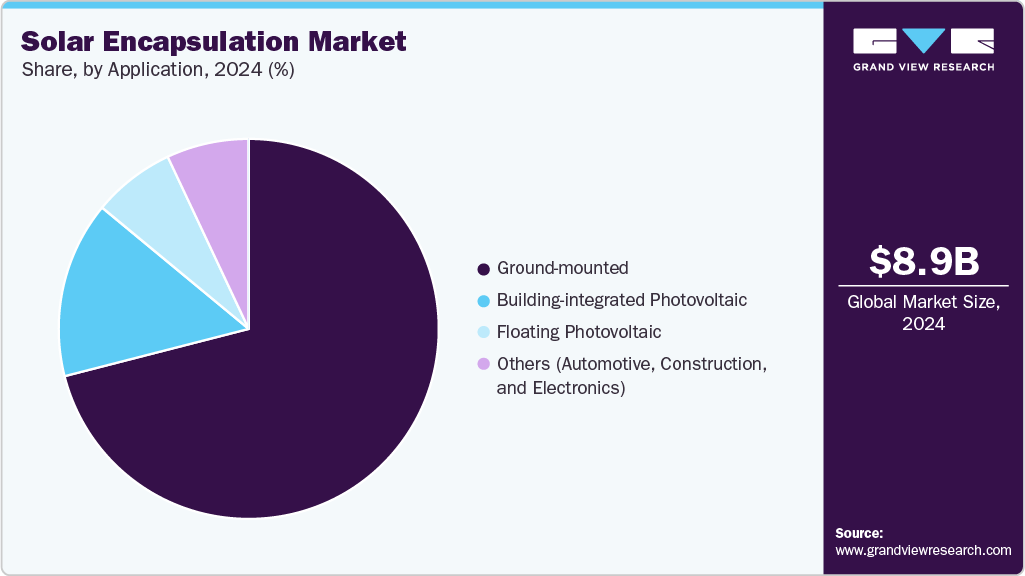

- By application, ground-mounted held the highest market share of 70.83% in 2024.

- Based on material, the Ethylene Vinyl Acetate (EVA) segment held the largest market share in 2024.

- Based on technology, the crystalline silicon solar segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.89 billion

- 2033 Projected Market Size: USD 16.99 billion

- CAGR (2025-2033): 6.9%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

The growing demand for renewable energy and continuous advancements in solar module designs are driving the market forward. In addition, increasing investments in large-scale solar energy projects and favorable government initiatives to reduce greenhouse gas emissions are expected to fuel market growth further.

Encapsulants are critical to the structural integrity and performance of crystalline silicon and thin-film solar technologies. Materials such as Ethylene Vinyl Acetate (EVA), Polyolefin, and Thermoplastic Polyurethane (TPU) dominate the landscape due to their cost-effectiveness and excellent optical and adhesive properties. The rising adoption of bifacial and high-efficiency PV modules is creating demand for next-generation encapsulation materials with better UV stability and lower degradation rates. Major solar-producing countries such as China, India, the U.S., and Germany are significantly contributing to market expansion through ambitious solar deployment targets and local manufacturing incentives. The market outlook remains strong as the global energy mix shifts toward clean and sustainable solutions.

Drivers, Opportunities & Restraints

The global solar encapsulation industry is driven by the rising deployment of solar photovoltaic (PV) systems across residential, commercial, and utility-scale applications, supported by international commitments to reduce carbon emissions. Government incentives, declining solar module costs, and increasing electricity demand in emerging economies encourage large-scale solar adoption. Encapsulation materials are critical in enhancing module durability, energy conversion efficiency, and lifecycle reliability, making them essential components in the broader solar supply chain. The shift toward high-efficiency technologies such as bifacial and heterojunction solar cells is boosting demand for advanced encapsulants with improved optical, adhesive, and UV-resistant properties.

Emerging opportunities in the market include the development of lead-free, UV-stable, and low-moisture transmission encapsulation films tailored for high-performance PV modules. Innovations like thermoplastic materials, ionomers, and silicones enable next-generation solar modules designed for extreme climates and extended service life. The growing emphasis on domestic manufacturing of solar components, particularly in the U.S., India, and Europe, further presents prospects for local encapsulant producers. However, the market faces restraints such as volatility in raw material prices, supply chain disruptions, and challenges in the recyclability of encapsulant layers during solar panel decommissioning. Moreover, intense price competition and the need for continual material innovation place pressure on manufacturers to balance cost and performance.

Material Insights

Ethylene Vinyl Acetate (EVA) segment held the largest revenue share of over 65.45% in 2024. The Ethylene Vinyl Acetate (EVA) segment emerged as the dominant material in the market, accounting for more than 65.45% revenue share in 2024. It is further projected to maintain its lead throughout the assessment period. EVA's widespread adoption is driven by its excellent optical transmission, strong adhesion to solar cells, and cost-effectiveness, making it the preferred choice for encapsulating crystalline silicon modules globally. The rapid expansion of solar PV installations, fueled by increasing electricity demand from population growth and accelerated urban development, continues to support segment growth. In addition, the global transition from conventional fossil fuel-based energy to solar power, particularly in economies such as China, India, the U.S., and Germany, further boosts demand for EVA-based encapsulation materials, especially in large-scale solar farms exceeding 200 MW.

The increasing module size and higher power ratings in utility-scale solar projects have underscored the importance of materials like EVA, which offer proven long-term durability and performance under varying climatic conditions. Its ease of lamination and compatibility with both front and rear surfaces of solar cells make it ideal for streamlined mass production. Furthermore, EVA sheets' lightweight nature and flexibility contribute to improved module handling and structural design, which is critical for emerging applications such as floating solar, building-integrated photovoltaics (BIPV), and desert-based installations. As the renewable energy landscape evolves, EVA is expected to retain a strong foothold, while newer alternatives like Polyolefin Elastomers (POE) and Thermoplastic Polyurethane (TPU) gain momentum in niche, high-efficiency segments requiring enhanced thermal and UV resistance.

Technology Insights

Crystalline silicon solar segment held the revenue share of over 84.40% in 2024. The crystalline silicon solar segment accounted for the largest revenue share of approximately 84.40% in 2024. The global rise in electricity demand due to rapid urbanization, industrial expansion, and population growth has significantly boosted the adoption of crystalline silicon solar technology, driving the use of encapsulation materials tailored for this segment. Crystalline silicon modules, including monocrystalline and multicrystalline types, are favored for their high energy efficiency, long operational life, and well-established manufacturing base. The segment’s dominance is expected to continue over the forecast period, supported by falling module costs, consistent technology improvements, and supportive policy frameworks promoting solar adoption at utility and commercial scales.

While crystalline silicon remains the backbone of the solar market, newer technologies such as thin-film and tandem cells are gradually gaining attention. However, skepticism remains among some major players regarding the scalability and durability of alternatives compared to traditional crystalline silicon. Material demand in this segment is also subject to supply chain fluctuations and pricing volatility in encapsulant components like EVA and POE. On the other hand, the thin-film segment is experiencing niche demand in applications like building-integrated photovoltaics (BIPV), flexible modules, and off-grid solutions. Nonetheless, the robust infrastructure supporting crystalline silicon module manufacturing and its proven field performance are expected to uphold its dominant share across established and emerging solar markets worldwide.

Application Insights

Ground-mounted held the largest revenue share of over 70.83% in 2024. The ground-mounted segment accounted for the largest revenue share of more than 70.83% in 2024 and is anticipated to maintain its dominance throughout the forecast period. This segment is also expected to grow faster over the coming years. Ground-mounted solar systems offer higher energy yields due to optimal tilt and orientation and are generally more scalable than rooftop alternatives. These systems are ideal for utility-scale solar farms, allowing for economies of scale in installation and maintenance. As global solar deployment accelerates, especially in countries with abundant land availability, the demand for durable and efficient encapsulation materials for ground-mounted projects is driving overall market growth.

Ground-mounted installations complement large-scale power generation strategies by delivering consistent energy output and enabling easier integration with grid infrastructure. Their modular design allows quick scaling to meet rising energy demands, especially in remote or under-electrified areas. Government mandates promoting renewable energy targets and utility procurement programs favor the rapid rollout of such systems. In addition, declining costs of solar modules and improved installation technologies are enhancing the viability of ground-based solar projects. The increasing adoption of bifacial modules in this segment, which require advanced encapsulants with dual-sided durability and UV stability, is also expected to create new growth opportunities for encapsulation material manufacturers over the projection period.

Regional Insights

North America's solar encapsulation industry is driven by expanding renewable energy integration and federal clean energy initiatives. The region is experiencing large-scale PV deployment in utility and distributed generation segments, prompting demand for encapsulants that offer durability, optical clarity, and long-term reliability. Declining solar installation costs, improved net metering policies, and investor interest in green infrastructure have catalyzed market expansion. In addition, the growth of bifacial modules and tracker-based systems, especially in U.S. solar farms, requires encapsulant materials that can withstand mechanical stress and UV degradation, accelerating the adoption of advanced solutions like polyolefin and thermoplastic polyurethane.

U.S. Solar Encapsulation Market Trends

The U.S. solar encapsulation industry is bolstered by a robust pipeline of solar projects backed by the Inflation Reduction Act (IRA) and state-level renewable portfolio standards (RPS). Ground-mounted solar PV installations across California, Texas, and Florida fuel the demand for durable encapsulation solutions tailored for high-output utility-scale modules. The resurgence of domestic solar manufacturing and the push for supply chain localization have also spurred investments in local encapsulant production. Moreover, the shift toward high-efficiency technologies, including heterojunction and bifacial cells, creates demand for next-generation encapsulants offering enhanced thermal and moisture resistance

Asia Pacific Solar Encapsulation Market Trends

Asia Pacific solar encapsulation industry held over 62% of global revenue share in 2024. Massive solar capacity additions in countries like China, India, and South Korea are primary growth drivers. These nations are aggressively shifting away from fossil fuels, supported by strong national solar policies, land availability, and competitive module manufacturing ecosystems. The rising deployment of utility-scale solar parks and government-led renewable energy missions continues to boost demand for high-performance encapsulation materials. Furthermore, APAC's position as a manufacturing hub for solar PV modules ensures strong domestic demand, with key regional players investing heavily in advanced encapsulant production capabilities and R&D.

Europe Solar Encapsulation Market Trends

The European solar encapsulation industry is propelled by the region's aggressive climate targets and increasing solar PV adoption under the EU's REPowerEU and Green Deal strategies. Countries like Germany, Spain, and the Netherlands lead utility-scale and rooftop solar deployment, driving consistent demand for encapsulation films that offer optical and mechanical stability. Europe's high module performance and recyclability standards are pushing manufacturers to innovate with environmentally friendly and durable encapsulant materials. In addition, increasing R&D activity and government incentives for domestic module manufacturing support the adoption of advanced encapsulation technologies across the region.

Latin America Solar Encapsulation Market Trends

Latin America's solar encapsulation industry is growing steadily due to rising investments in renewable energy infrastructure across Brazil, Chile, and Mexico. The region's abundant solar irradiance and increasing demand for decentralized energy solutions make it an attractive landscape for utility-scale solar deployment. Government-backed energy auctions and feed-in tariff programs encourage the expansion of solar parks, where EVA and POE encapsulants enhance panel durability. Moreover, integrating solar energy into industrial and off-grid rural applications further diversifies encapsulation demand, especially for products that can withstand high temperatures and humidity.

Middle East & Africa Solar Encapsulation Market Trends

The Middle East & Africa solar encapsulation industry is witnessing growth driven by ambitious solar initiatives in Saudi Arabia, the UAE, Egypt, and South Africa. National Vision programs and renewable energy targets are accelerating utility-scale solar PV deployment, boosting the consumption of encapsulants designed for desert environments with high UV exposure and temperature fluctuations. The emergence of floating solar plants and hybrid solar-diesel solutions in off-grid areas also presents new opportunities for weather-resistant encapsulant materials. As solar module manufacturing capabilities expand within the region, demand for localized, high-performance encapsulation solutions is expected to rise.

Key Solar Encapsulation Company Insights

Some of the key players operating in the solar encapsulation industry include First Solar, DuPont, 3M, Dow, Mitsui Chemicals, Inc., among others. These companies are actively investing in research and development to innovate high-performance encapsulant materials such as EVA, POE, and TPU to meet evolving module efficiency and durability requirements.

Key Solar Encapsulation Companies:

The following are the leading companies in the solar encapsulation market. These companies collectively hold the largest market share and dictate industry trends.

- First Solar

- DuPont

- 3M

- Dow

- Mitsui Chemicals, Inc.

- HANGZHOU FIRST APPLIED MATERIAL CO., LTD.

- LG Chem

- JA SOLAR Technology Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- RenewSys India Pvt. Ltd.

Recent Developments

- In February 2025, Shin-Etsu Chemical Co., Ltd. announced the expansion of its solar encapsulation manufacturing operations in Houston, Texas. The new facility aims to enhance the production of advanced, high-performance encapsulant materials designed for next-generation photovoltaic modules, including bifacial and high-efficiency solar cells. This strategic move supports the rising demand for durable, UV-resistant, and thermally stable encapsulations as utility-scale solar projects gain momentum across the U.S. The expansion is also expected to generate approximately 400 skilled jobs and reinforce the domestic solar supply chain, aligning with federal efforts to boost clean energy manufacturing and reduce dependence on imports.

Solar Encapsulation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.97 billion

Revenue forecast in 2033

USD 16.99 billion

Growth rate

CAGR of 6.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Russia; Italy; Spain; Norway; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

First Solar; DuPont; 3M; Dow; Mitsui Chemicals, Inc.; HANGZHOU FIRST APPLIED MATERIAL CO., LTD.; LG Chem; JA SOLAR Technology Co., Ltd.; Shin-Etsu Chemical Co., Ltd.; RenewSys India Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Solar Encapsulation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global solar encapsulation market report based on material, technology, application, and region.

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Ethylene Vinyl Acetate (EVA)

-

Thermoplastic Polyurethane (TPU)

-

Polyvinyl Butyral (PVB)

-

Polydimethylsiloxane (PDMS)

-

Ionomer

-

Polyolefin

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Crystalline Silicon Solar

-

Thin-Film Solar

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Ground-mounted

-

Building-integrated photovoltaic

-

Floating photovoltaic

-

Others (Automotive, Construction, and Electronics)

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

Italy

-

Spain

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global solar encapsulation market size was estimated at USD 8.89 billion in 2024 and is expected to reach USD 9.97 billion in 2025.

b. The global solar encapsulation market is expected to grow at a compound annual growth rate of 6.9% from 2025 to 2033 to reach USD 16.99 billion by 2033.

b. Based on the Application segment, Ground-mounted held the largest revenue share of more than 70.83% in 2024.

b. Some of the key vendors in the global solar encapsulation market include Shin-Etsu Chemical Co., Ltd., First Solar, DuPont, 3M, Dow, and Mitsui Chemicals, Inc., among others.

b. The key factors driving the solar encapsulation market include the rapidly growing adoption of solar photovoltaic (PV) technology across residential, commercial, and utility-scale applications. As the global shift toward renewable energy accelerates, the demand for durable, high-performance encapsulant materials is rising to ensure long-term module efficiency and protection.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.